Nursing school is often described as academically intense, emotionally demanding, and physically exhausting. What’s talked about far less—but felt just as deeply—is the financial strain. Tuition is only the beginning. By the time you factor in clinical requirements, lost work hours, exam fees, transportation, and basic living expenses, many nursing students find themselves wondering how they’re supposed to survive financially while chasing a career built on caring for others.

If you’re feeling overwhelmed by money stress during nursing school, you’re not failing. You’re experiencing a reality shared by thousands of students across the country. The good news is that surviving nursing school financially is possible—not by being perfect with money, but by being intentional, informed, and strategic.

This guide breaks down what nursing school really costs, where to find financial support, how to work without destroying your GPA, and how to think about money in a way that helps you finish strong. The goal isn’t to get rich during nursing school. The goal is to stay enrolled, protect your mental health, and graduate.

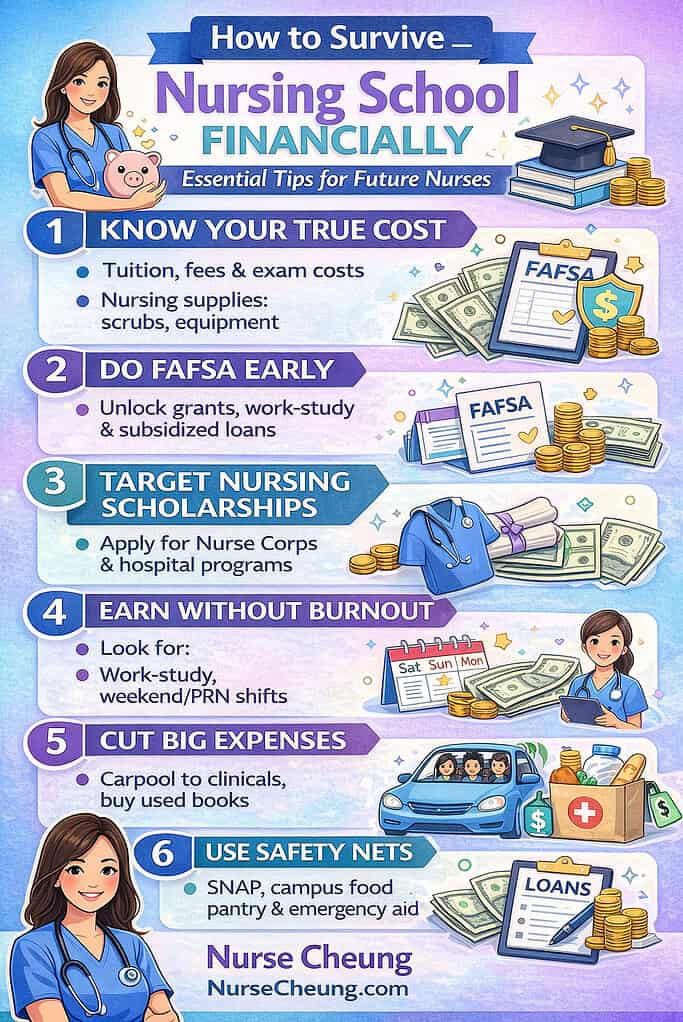

The True Cost of Nursing School: What Students Don’t Budget For

When most people think about the cost of nursing school, they think about tuition. Tuition is visible, predictable, and usually listed clearly on a school’s website. What catches students off guard are the dozens of smaller, recurring expenses that quietly drain their bank accounts semester after semester.

Nursing programs come with unique requirements that other majors simply don’t have. Background checks, drug screens, CPR certification, immunizations, titers, uniforms, clinical shoes, stethoscopes, testing platforms, parking fees, and transportation to clinical sites all add up quickly. Many of these costs are non-negotiable. If you don’t pay them, you don’t progress in the program.

Then there’s the cost of time. Nursing school often limits your ability to work full-time. Clinical days are long, unpaid, and inflexible. Study time isn’t optional if you want to pass. That reduction in earning capacity is one of the most underestimated financial challenges nursing students face.

On top of that are everyday living expenses: rent, utilities, groceries, childcare, phone bills, and internet access. These don’t pause just because you’re in school. When students say nursing school is financially overwhelming, they’re not being dramatic—they’re describing the collision between rising expenses and shrinking income.

The first step to surviving nursing school financially is acknowledging the full cost of attendance, not just tuition. Awareness creates planning. Planning creates survival.

Start With Free Money First: FAFSA, Grants, and Financial Aid Basics

One of the most important financial decisions a nursing student can make happens before classes even begin: completing the FAFSA. The Free Application for Federal Student Aid is the gateway to grants, work-study, federal loans, and often state or institutional aid. Even students who believe they “won’t qualify” should still file.

Grants are the most valuable form of aid because they don’t have to be repaid. Federal grants, state grants, and institutional grants can significantly reduce the amount you need to borrow or earn while in school. For many nursing students, grant money ends up covering part of their rent, groceries, or transportation—not just tuition.

Work-study is another underused option. While it doesn’t make you rich, work-study jobs are often more flexible and understanding of academic schedules than off-campus jobs. Many are located on campus or in affiliated facilities, which can reduce commuting costs and scheduling conflicts.

The timing of your FAFSA submission matters. Aid is often distributed on a first-come, first-served basis, especially at the institutional level. Filing early gives you access to more options. Filing late limits your choices.

Free money should always come before borrowed money. Grants and work-study reduce financial pressure now and protect your future income after graduation.

Nursing-Specific Scholarships and Programs Most Students Miss

Beyond general financial aid, nursing students have access to scholarships and funding programs designed specifically for the nursing workforce. Unfortunately, many students never apply because they don’t know these programs exist or assume they’re too competitive.

There are national nursing scholarships, local hospital-sponsored awards, community foundation grants, and service-based programs that exchange funding for future work commitments. These programs exist because healthcare systems need nurses, and investing in students early is part of their long-term staffing strategy.

Service-based programs are particularly powerful. Some cover tuition and provide a monthly stipend while you’re in school in exchange for a commitment to work in an underserved area after graduation. Others offer loan repayment once you’re licensed and employed. These options can dramatically reduce long-term debt, especially for students who already plan to work in public service or nonprofit healthcare settings.

Scholarship applications take time, but they are one of the highest-return activities you can do as a nursing student. Even a few thousand dollars can mean fewer work hours, lower stress, or less borrowing.

Think of scholarships not as charity, but as workforce investment. You are the future of healthcare, and many organizations are willing to help fund that future.

Working During Nursing School: How to Earn Without Wrecking Your GPA

For most nursing students, working during school isn’t optional. Bills don’t disappear just because you’re enrolled in a demanding program. The challenge is finding income strategies that support your education instead of sabotaging it.

Not all jobs are equal when you’re in nursing school. Positions with rigid schedules, unpredictable hours, or high physical and emotional demands can quickly lead to burnout. While any income may seem better than none, working too much—or in the wrong environment—can cost you far more if it leads to failed courses or delayed graduation.

Better options often include work-study roles, weekend-only shifts, per-diem healthcare positions, or jobs with employers who understand academic demands. Some students find that working fewer hours at a slightly higher-paying or more flexible job ends up being more sustainable than juggling multiple low-pay roles.

The most important rule is this: your GPA is an income strategy. Failing a course costs tuition, time, and emotional energy. Graduating on time gets you into the workforce faster. When choosing how much to work, always measure the trade-off between short-term cash and long-term progress.

Working during nursing school should support your goal of graduating—not compete with it.

Cutting Costs Where It Actually Matters

Financial advice often focuses on extreme frugality, but nursing students don’t need guilt or deprivation—they need efficiency. The biggest gains come from managing the largest expenses, not obsessing over every small purchase.

Housing, food, and transportation are the primary cost drivers for most students. Sharing housing, negotiating rent when possible, or living closer to campus or clinical sites can reduce both rent and transportation costs. Carpooling to clinicals, planning errands strategically, and minimizing unnecessary driving can also add up over time.

Food costs are another major pressure point. Long clinical days make meal planning difficult, which leads to expensive convenience purchases. Preparing simple, repeatable meals and snacks can significantly reduce spending while also supporting physical endurance during long shifts.

Nursing-specific costs can sometimes be reduced by buying used supplies, sharing resources with classmates, or avoiding duplicate prep materials. Many students overspend on multiple study tools when one solid resource would suffice.

Saving money in nursing school isn’t about living miserably. It’s about directing your limited resources toward what actually helps you succeed.

Support Systems You’re Allowed to Use (Yes, Really)

One of the most damaging myths in higher education is that struggling financially is a personal failure. In reality, many college students—including nursing students—experience food insecurity, housing instability, or emergency financial crises during their education.

Many campuses now offer emergency grants, food pantries, short-term assistance, and referrals to community resources. These supports exist to help students stay enrolled during difficult periods. Using them does not mean you lack discipline or responsibility. It means you are doing what’s necessary to finish your program.

Some students may also qualify for public assistance programs during school, depending on their circumstances. Eligibility rules can be complex, but exploring options can make a meaningful difference in day-to-day stability.

Survival is not weakness. Staying enrolled is success. Accepting help during a temporary season does not define your future—it protects it.

Borrowing Smart: How to Use Student Loans Without Destroying Your Future

For many nursing students, loans are part of the financial picture. The goal is not to avoid borrowing at all costs, but to borrow intentionally.

Federal loans generally offer more protections, flexible repayment options, and forgiveness pathways than private loans. Borrowing only what you need—not the maximum offered—can significantly reduce stress after graduation.

Understanding your repayment options before you graduate is critical. Nurses who work in nonprofit or public healthcare settings may qualify for loan forgiveness programs. Others may have access to employer-sponsored repayment benefits. Planning ahead allows you to make employment decisions that align with both your career goals and financial health.

Loans are tools. Used thoughtfully, they can help you complete your education. Used blindly, they can limit your freedom. Knowledge is what makes the difference.

The Payoff: Why Surviving This Season Is Worth It

Nursing school is one of the most demanding educational paths, but it leads to a career with strong earning potential, job stability, and geographic flexibility. The financial sacrifices you make during school are temporary. The skills and credentials you earn are not.

Graduating on time, with manageable debt and intact mental health, puts you in a powerful position. Every smart financial decision you make during nursing school shortens the time it takes to reach stability after graduation.

This season is not forever. It is a bridge between who you are now and the nurse you are becoming.

You Don’t Need to Be Rich—You Need a Plan

Surviving nursing school financially isn’t about perfection. It’s about awareness, prioritization, and using the tools available to you.

Know the true cost of your program. Start with free money. Apply for nursing-specific funding. Work strategically. Cut costs where it matters. Use support systems without shame. Borrow with intention.

Most importantly, remember this: struggling financially in nursing school does not mean you don’t belong. It means you are navigating a demanding system while building a future that will allow you to care for others—and yourself.

If this post helped you, share it with a classmate who’s quietly stressing about money. And come back often. You don’t have to do this alone.